Establishing a successful business partnership in Texas requires a practical approach involving clear communication, mutual respect, and shared goals. The thriving economic landscape in Texas provides the opportunity for partnerships across many industries. It is essential to lay a solid foundation for a successful business partnership by carefully drafting a partnership agreement outlining roles, responsibilities, and conflict resolution mechanisms. Emphasizing transparency and accountability from the outset can help the partnership have sustainable growth and profitability while also adapting to Texas’s unique business culture and regulatory environment.

Forming a successful business partnership in Texas involves a series of well-defined steps, from the initial planning phase to the legal formation and operational implementation.

Steps To Form A Business Partnership In Texas

- Evaluate the Need for a Partnership: Assess why you need a partner before entering a partnership. Partnerships are beneficial for pooling resources and expertise and sharing risks. Ensure that the partnership aligns with your business goals and growth strategies.

- Choose the Right Partner: Selecting a compatible partner is crucial. Look for someone with complementary skills, a shared vision, and similar values. Consider the partner’s financial stability, business acumen, and trustworthiness. A thorough background check and references can be beneficial.

- Decide on the Type of Partnership: Texas recognizes a few types of partnerships:

- General Partnership (GP): All partners manage the business and are personally liable for debts.

- Limited Partnership (LP): Includes both general and limited partners; limited partners have limited liability.

- Limited Liability Partnership (LLP): Offers liability protection to all partners for the partnership’s debts.

- Draft a Partnership Agreement: A comprehensive partnership agreement is foundational. This document should outline the roles and responsibilities of each partner, the contribution of capital and assets by partners, profit and loss distribution, decision-making processes, conflict resolution mechanisms, and procedures for adding or removing partners.

- Exit strategies: Consider hiring a lawyer experienced in Texas business law to ensure the agreement complies with state regulations and adequately protects all parties’ interests.

- Register the Partnership: Depending on the partnership type, you may need to register with the Texas Secretary of State. For example, LPs and LLPs must file a certificate of formation and the appropriate fee. GPs may operate without state registration, but registering can offer benefits like name protection.

- Obtain Necessary Licenses and Permits: Research and obtain your business’s required local, state, and federal licenses and permits. Requirements can vary widely depending on the nature of your business and its location.

- Get an Employer Identification Number (EIN): Even if you do not plan to have employees immediately, an EIN from the IRS is necessary for tax purposes, opening a business bank account, and more.

- Set Up Financial Systems: Open a business bank account in the partnership’s name to separate personal and business finances. Establish an accounting system to manage finances, including profits, losses, and partner contributions.

- Understand Tax Obligations: Partnerships generally do pay income tax. Instead, profits and losses pass through to the partners, who report them on their tax returns. However, understanding and planning for other tax obligations, like self-employment taxes, is essential.

- Review and Comply with Employment Laws: If you plan to hire employees, ensure compliance with Texas employment laws regarding wages, safety, discrimination, and benefits. Register for unemployment insurance tax and worker’s compensation insurance.

- Ongoing Compliance and Management: Maintain good standing with the state by filing any required annual reports and renewing licenses and permits. Regularly review the partnership agreement and adjust it as the business evolves.

- Seek Professional Advice: Consult with legal and financial professionals throughout the process to navigate complex regulations and tax laws effectively. You want to ensure the partnership is set up correctly and compliant.

Conclusion

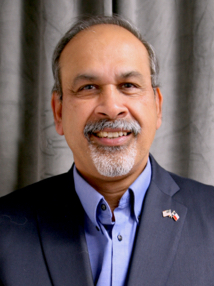

Forming a successful business partnership in Texas requires careful planning, clear communication, and ongoing management. By following the above steps, you can establish a solid foundation for your partnership and position your business for success. You must consult with an experienced business planning law firm who can help ensure that you are taking all of the necessary steps to protect yourself and your new business. Kumar Law Firm PLLC has highly skilled Texas attorneys who can assist you with the steps required for a successful business formation. Contact our office for an initial consultation.