Setting up shop on your own can be a daunting prospect. A sole proprietorship is a business that is owned and managed by just one person. While more than one person may be helping with business operations, the business is still owned by a single individual. As a sole proprietor, you hold all of the power of running your business, but you also bear all of the responsibility. Many avoid sole proprietorship because it exposes the business owner to liability and makes him or her personally liable for business losses. A sole proprietorship, however, has several big advantages that may make it the perfect fit for you.

Benefits of a Sole Proprietorship

Sole proprietorship is by far the most common type of business entity. Its simplicity of form, procedure, and set up make it an attractive option. There are minimal required licenses. Paperwork and other formalities of setting up the business are minimal. It is also generally less expensive to set of a sole proprietorship. Lowering expenses is a big plus for new business owners, especially when it may be difficult to find business investors.

While it is true that having a sole proprietorship exposes the owner personally for business losses and liabilities, a sole proprietor also enjoys sole control of all business profits. In fact, you are in total control of your business. All business decisions are in your hands. There is no need to get approval from business partners or officers or directors or shareholders. Seeking approval from these people is necessary in partnerships and LLC, among other types of business holdings.

The privacy aspect of a sole proprietorship is also an advantage. Not only is there no need to file formation documents, but you will not need to file an annual report with the state or federal governments. Sole proprietorships are not required to make public disclosures like an LLC or a corporation. LLCs and corporations are also legal required to conduct member and shareholder meetings. With a sole proprietorship, you do not need to worry about filing these reports with the government or keeping shareholders and other business members apprised of business dealings.

Additionally, a sole proprietorship enjoys simplified tax reporting. There is no need to pay separate taxes for a sole proprietorship. There is no need to file special tax forms with the state or federal governments. Usually, the only tax form required of a sole proprietor is filing a Schedule C- Profit or Loss from a Business with the IRS as a part of their annual Form 1040.

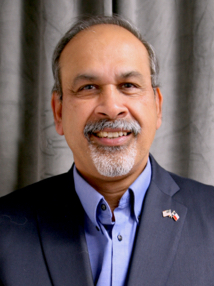

Texas Business Law Attorney

If you are looking to set up your own business, make sure a sole proprietorship is your best option. The Kumar Law Firm is here to answer all of your business formation questions and counsel you on your best options. Contact us today.